Stress no more. Let us take care of your tax affairs

Complying with complicated regulations while keeping abreast of the changes in legislation can be extremely stressful. Our tax consultants will aim to relieve you of this stress with our comprehensive tax services. We will give you the best guidance and assistance to ensure full compliance with ever-changing South African legislation.

We assist with compliance by means of value-added solutions to address your unique needs.

Our services include, but are not limited to:

- Personal income tax planning

- Individual income tax

- Provisional tax returns completion and submission (IRP6)

- Completion and submission of annual personal income tax returns (IT12)

- Registration for income and provisional tax

- Business expenses

- Tax advice and planning

- Dealing with SARS queries, objections and appeals

- VAT registrations and returns

- Companies tax South Africa

- Small business tax

- Corporate income tax returns completion and submission (IT 14)

- Tax clearance certificates

- PAYE tax registration and returns

- EMP 501's

- Tax directives

- IT14 SD

Benefits of our taxation services

Our tax professionals have years of experience and knowledge, which help us deal with your specific taxation needs. We can provide the following benefits for your company or organisation:

Tailored approach

We don’t believe in a one-size-fits-all approach but rather strive to understand your business completely so that we can help your business reach its full potential.

Extensive knowledge

We have extensive knowledge in a range of industries. This helps us deliver rich insights and innovative personal services that can help your company reach full compliancy while finding growth opportunities.

Full range of services

Our team of professionals provide a full range of services - we take a holistic approach when it comes to our services to make sure we can offer the best support and advice when you need it.

The extra mile

We go further than just managing your tax affairs - we take your long-term goals into consideration and help you achieve them.

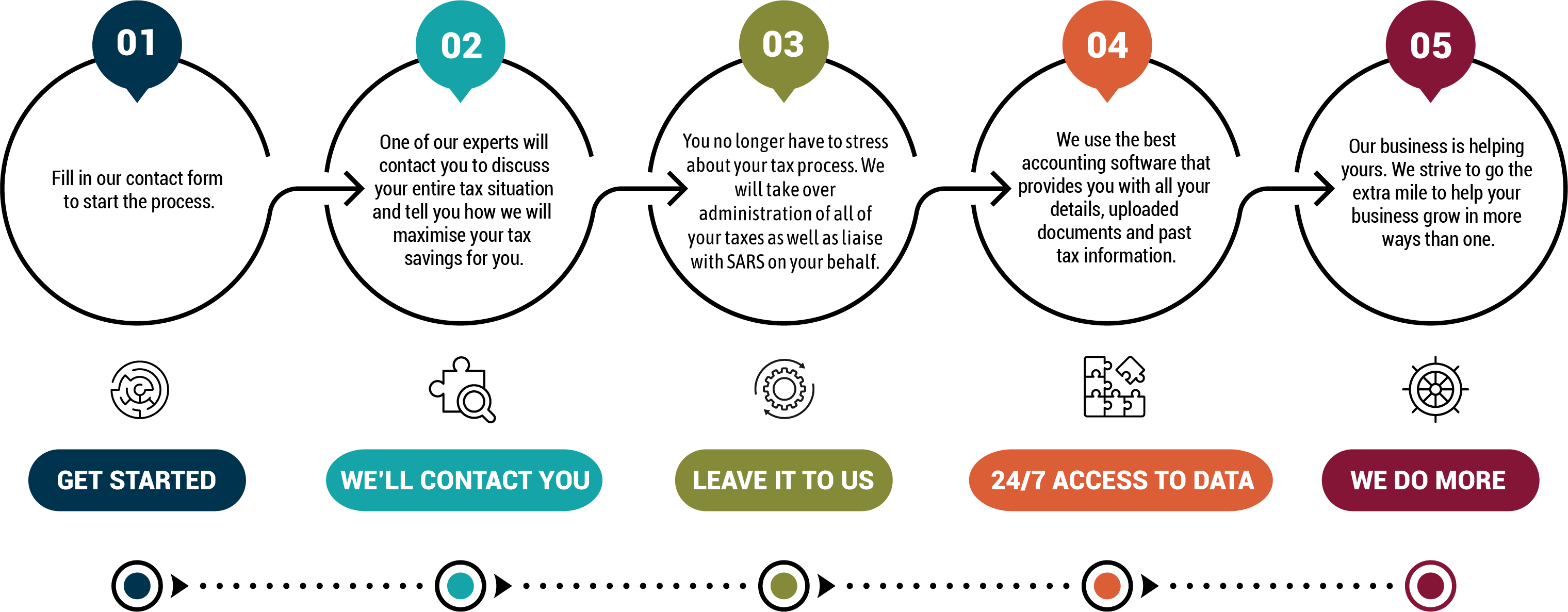

Our simple taxation process